I'm mainly a long trader, but I will occasionally take the right set-up in some of the triple short index ETFs. However, that's still "long" a short fund. It's just what seems to work for me right now. 2013 was really tough for shorts (at least for me vs. the indexes). You had to be very quick in recognizing the turn, scale some profits, raise your stop and make sure you didn't give it all back when the indexes gapped up on Tuesday or Friday. As the "Bill the Cat" cartoon likes to say, "ACk!". I was lucky to scrape out a few pennies on more than one occasion last year.

Here's a short set-up that I'm watching in SCO:

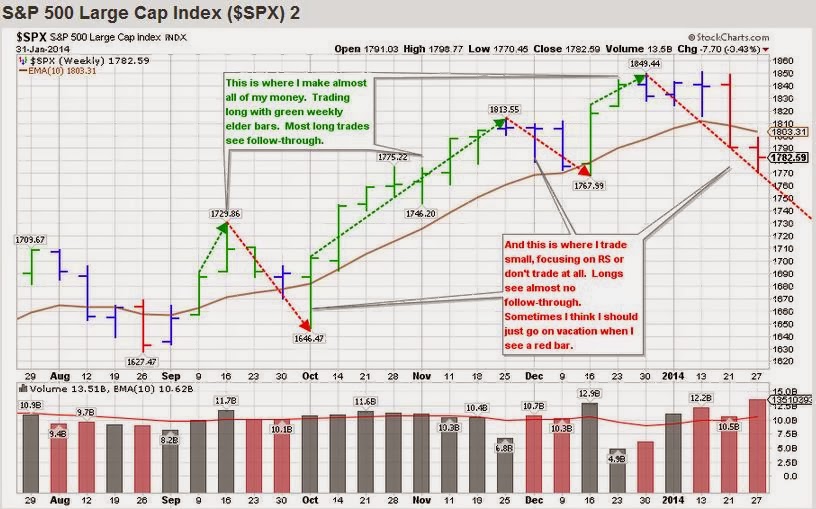

Given my preference to trade on the long side, I tend to make most of money when the $SPX has green weekly elder bars and is trending up. The trend might last 2 weeks or 10 weeks or more. Sometimes I can squeeze another week of decent profits out at the top by focusing on relative strength in individual stocks while we trend sideways in the $SPX. I need to get better at pressing harder during these periods - in any case, this is where I make my money.

On the flip side, when the $SPX is slipping down with blue or red elder bars - it's a struggle for me to trade on the long side. Most of my long trades see no follow-through at all. Therefore, I trade small or not at all. For example, this week I saw some relative strength divergences in ETFs like: IWO, IWC, IJH, MDY, XLF, FAS, TAN, and IBB - all of which failed to make a lower low on Wednesday and bounced sharply on Thursday. You had to be quick in identifying that trade, taking profits, and raising stops or you gave back some profits on Friday. My trades here are mainly short-term rentals which need lots of attention and quick fingers. Another option is to take long set-ups in the double and triple short ETFs if I see low risk entries (like SCO above).

So, here's the question that I'm thinking about right now: Is it worth it?

The way I see it, there's 4 options while the market is sliding downwards:

1. Sit in cash and watch from the sidelines. Kind of boring, but also a good time to reflect + spend more family time (which is also very valuable).

2. Try to catch small bounces on the long side. Reminds me of jumping in front of a bus to pick up a penny.

3. Short a market that's basically crushed shorts since summer of 2011. One of these times it's going to work, but that same logic can cause drawdowns.

4. Some hybrid of the above.

Right now, I'm feeling like doing some hybrid of the 3 options. I don't want to lose touch with the markets, but I also have no interest in losing the money that I make during uptrends.

So, that's my plan: trade small, keep lots of cash, hang out with my daughter, and wait for the eventual turn and for green bars to come back!

For more charts (and less words), see my public chart list on stockcharts.com:

http://stockcharts.com/public/1109955

No comments:

Post a Comment